Introduction

The web hosting industry is evolving at record speed and so are the economics driving it.

Hosting companies, domain resellers, and digital agencies are facing a complex mix of rising infrastructure costs, intense competition, and growing customer expectations for uptime, security, and speed. As hyperscalers strengthen their grip on global infrastructure, smaller players are under pressure to do more with less.

In this environment, success is no longer just about offering server space: it’s about streamlining operations, increasing margins, and providing value-added services that build long-term client trust.

This article explores some of the latest data behind the global hosting industry, from growth projections to market share, and what it means for your business.

If you resell hosting, domains, or online infrastructure services, the stats below should inform your roadmap into 2025 and beyond.

Global web hosting market data and growth projections

The global web hosting market continues to expand aggressively, with demand driven by e-commerce, SaaS growth, and the rising dominance of online-first businesses. At the same time, the industry remains highly fragmented, with over 330,000 hosting providers operating worldwide.

Market size and growth rate

According to DemandSage 1, the web hosting market grew from US $130.1 billion in 2023 to US $159.9 billion in 2024. It’s projected to reach US $192.8 billion in 2025 and an impressive US $355.8 billion by 2029. This implies a compound annual growth rate (CAGR) of 17.35% between 2024 and 2029.Hostinger’s report offers an even more aggressive forecast, citing a CAGR of 23.6%, projecting the market to nearly triple by 2029. Either way, the message is clear: demand for hosting infrastructure is growing steadily, if not exponentially.

Regional distribution and trends

North America remains the largest market, with the U.S. generating $57.74 billion in hosting revenue in 2024 2.

In 2025, North America is projected to dominate the global web hosting market, accounting for 39% of total share. Close behind are Europe and Asia Pacific, where digital transformation efforts and rising internet adoption are fueling growth. South America, while representing a smaller portion of the market, is experiencing consistent year-over-year expansion, particularly in ecommerce and SaaS 3 .

Top players and leading products

- AWS leads with 13% of the global hosting market 2 and holds anywhere from 29–32% of the global cloud infrastructure market (various sources 4)

- Google Cloud, Microsoft Azure, and Cloudflare collectively account for over 60% of the cloud infrastructure layer, though many SMBs still rely on shared hosting services 2.

- Microsoft Azure holds 20–23%, and Google Cloud holds 12–13% 5.

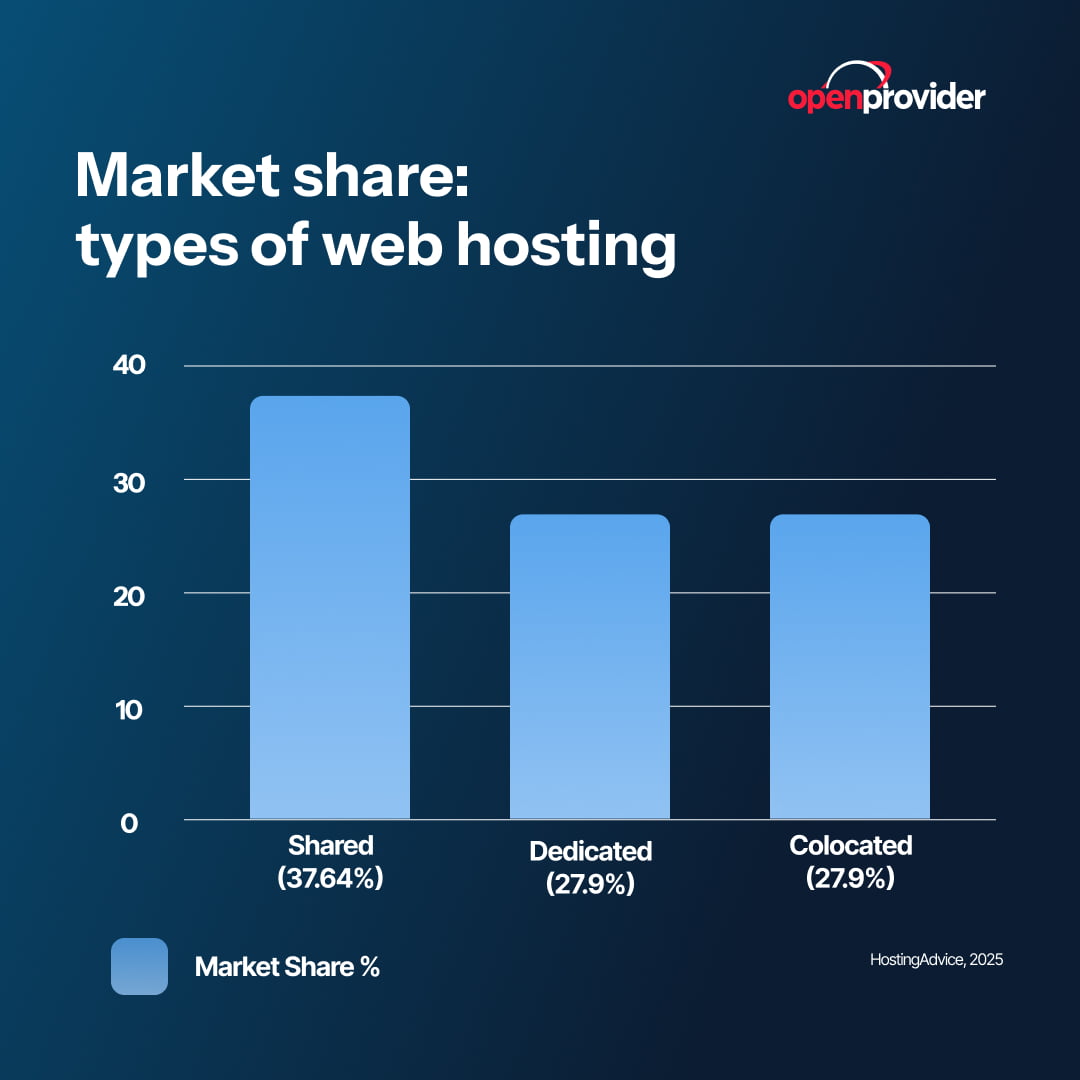

- Shared hosting remains the largest segment, representing 37.6% of the market 2.

- Reseller, VPS, and dedicated hosting account for the rest, each playing a key role in regional and SMB-focused strategies.

The shifting economics of web hosting

Web hosting was once a high-margin, infrastructure-heavy business. But today, it’s increasingly commoditized, with slimmer profit margins and aggressive price competition across the board. Hyperscalers like AWS and Google Cloud now define the cost structure of infrastructure, making it harder for smaller hosters and resellers to differentiate purely on technical performance or pricing.

In this new economy, hosting companies must rethink how they generate value and where they extract margin.

Hosting is getting cheaper for end users, but not easier

In highly saturated markets, reseller hosting businesses face what many call the “race to the bottom” in pricing: with over 330,000 providers worldwide, the key is to avoid this trap by doubling down on automation, bundling, and service quality.

However, price-only positioning is no longer sustainable. According to several sources, shared hosting represents 37.6% of the market 6, but many resellers in this space see shrinking ROI, especially those relying on manual operations or fragmented vendors.

The entry-level hosting market demonstrates price wars driving margins below sustainable levels.

Analyzing several sources 6 with compounded data of 1,200 hosting plans shows:

- The typical introductory price in 2020 averaged $3.50-$4.00 per month.

- The typical introductory price in 2024 averages $2.50-$3.50 per month.

That implies a decline of roughly 15-30%.

| Year | Basis used in this review | Representative providers (intro price, 12-36 mo. term) | Mean of sample |

| 2020 | Public “first-term” promo rates | Bluehost $2.95, SiteGround $3.95, DreamHost $2.59, InMotion $6.39, HostGator $2.75, A2 Hosting $2.99, iPage $1.99, GoDaddy $5.99 | $3.70 |

| 2024 | Public “first-term” promo rates | Hostinger $2.99, HostAdvice average $1.49, WPBeginner range $2.51 | $2.33 |

With an estimated change of -37% over four years – Editor note.

And, while infrastructure costs per gigabyte have dropped thanks to scale, overall operational costs are rising. Hosting businesses are now navigating:

- surging energy prices

- increased security and compliance requirements

- pressure to maintain 24/7 uptime and support

- rising expectations for automated provisioning and localization

Thus the emphasis is really not anymore on the question of “is there a price war?”, but rather on asking how we as hosting providers can be efficiently more profitable.

Reselling as a counter to the price war

To stay profitable, savvy providers are:

- moving toward automated platforms and integrations (e.g., WHMCS)

- consolidating vendors to reduce overhead

- bundling value-added services like SSL, DNS, and domain management

- leveraging API-driven backend systems for scalability and control.

To do that, relying on an infrastructure that allows us to centralize service operations and reselling itself is one requirement.

The other is packaging products profitably, so that customers are naturally called to hang around one provider only.

Openprovider’s Membership model is an example of how this strategy plays out in practice. By offering domains at registry cost prices, and rebates on add-ons, hosters can maintain profitability while offering real savings to their clients.

Main and ancillary services to bundle up can include:

- Domain name reselling (to own the full customer lifecycle)

- SSL certificates

- Premium DNS and security solutions

- Integration licenses (e.g., Plesk, EasyDMARC)

Building for long-term retention, not just short-term sales

Margins don’t grow from low prices: they grow from high retention and value-added services.

In fact, Openprovider’s internal data is showing that most growth in domain volume comes from Members who focus on consolidation, automation, and multi-product adoption.

Resellers who offer simple, bundled solutions and remove billing surprises or panel frustrations can increase:

- Average revenue per user (ARPU)

- Customer lifetime value (CLV)

- Renewal rates

Opportunities for growth in the hosting industry

Despite margin pressure and market saturation, hosting providers and resellers still have plenty of room to grow, if they adapt to where the market is heading.

1. Bundled services mean retention

Clients no longer want fragmented vendors. They want hosting + domains + DNS + SSL in one place. Providers who bundle these services increase retention and average revenue per user (ARPU).

What to do:

Streamline your offer. Use APIs or reseller platforms to consolidate billing, renewals, and support. Contact us to set up a bundling strategy

2. Security is no longer optional

SSL, DNSSEC, 2FA, GDPR compliance: clients expect it all by default. Offering basic or no security is a churn risk.

What to do

Upsell advanced security tools like SSL certificates, DNS monitoring, and spam filtering. These are high-margin and sticky.

3. Automation equals profitability

Manual provisioning wastes time and drains margin. Agencies and IT teams want self-service portals and integrations.

What to do

Integrate via Openprovider’s API and with modules like WHMCS when necessary. Automate domain lifecycle, SSL issuance, and DNS record management.

4. Niche markets are underserved

Exotic and niche TLDs like .ai and .io, white-label services, and regional hosting still lack competition. Smaller providers can win here by being faster and more localized than hyperscalers.

What to do

Differentiate with unique TLD offerings, localized support, and tailored onboarding for agencies and freelancers, by using the cost price model to buy at wholesale price and resell profitably.

5. Platform consolidation is a real need

Many resellers inherit domains from multiple registrars and platforms. Managing these portfolios is inefficient.

What to do

Offer seamless transfer-in tools, and centralized domain + DNS + hosting management, and manage it through a unified dashboard.

Reseller hosting in 2025: still profitable?

Reseller hosting has long been a popular entry point for digital entrepreneurs, web agencies, and IT consultancies looking to offer hosting services without owning physical infrastructure. But in 2025, with margins under pressure and infrastructure costs being dictated by cloud giants, is it still a viable business?

The answer is yes, but only if resellers rethink their approach.

Traditional reseller models are outdated

The legacy model of buying white-labeled shared hosting space and reselling it with a markup is under intense pressure.

With hyperscalers and mass-market providers offering hosting at razor-thin margins (often subsidized by other parts of their business) resellers relying purely on price are finding themselves squeezed out.

Common challenges in the traditional model:

- difficulty in managing manual provisioning and ticketing

- low customer retention due to commoditized offers

- high churn risk from billing or support inconsistencies

- difficulty consolidating domain, DNS, SSL and hosting billing in one place

Profitability comes from bundling, not volume

In 2025, successful reseller hosters shift from selling basic hosting to offering complete digital identity solutions. This includes:

- Domain name reselling at scale

- SSL certificates via advanced security packages

- Premium DNS

- Integration licenses

And manage all of these bundles via their reseller-focused control panel and integrations

Instead of chasing volume, they build around:

- automation (via APIs or WHMCS/Blesta integrations)

- bundles that deliver value, not just services

- platform efficiency: one balance, one control panel, full visibility

This model doesn’t just preserve profit margins: it grows them.

Because it aligns with the needs of time-poor, trust-driven clients like agencies and IT teams who don’t want x different vendors and x renewal dates.

Openprovider: designed for modern resellers

At Openprovider, we’ve built our ecosystem around the success of resellers. Our Membership model allows companies of all sizes to:

- Buy domains at cost price

- Get exclusive discounts on hosting-related products like SSL, SpamExpert, and Plesk licenses

- Access rebates and MDF programs to boost margins

- Manage everything via our Reseller Control Panel or REST/XML API

For example, resellers using our API or WHMCS integrations can fully automate:

- Domain registration and renewals

- SSL issuance and management

- DNS record provisioning

These are exactly the areas where legacy reseller hosters lose time and revenue.

Our customers report stronger retention and upsell results because they control the entire experience, from domain to hosting, without technical or financial friction.

Conclusion: hosting is changing – are you ready?

The hosting industry in 2025 is high-growth, high-pressure, and no longer forgiving of inefficiency. Infrastructure is cheaper but more complex. Customers expect more, margins are thinner, and success now depends on automation, consolidation, and the ability to deliver value beyond hosting alone.

At Openprovider, we’ve built our platform around exactly that reality.

We’re not just another domain provider. We’re a growth partner for modern hosters, agencies, and digital entrepreneurs who want:

- full control over their domain and hosting infrastructure

- predictable, transparent pricing through our Membership program

- access to cost-price domains and rebates on bundled services

- automation tools to integrate everything into one seamless operation

Whether you’re managing 50 domains or 50,000, Openprovider helps you save time, reduce friction, and grow smarter, not just bigger.

Sources

1: 70 Web Hosting Statistics of 2025 (Market Size & Trends) – DemandSage

3: 25 Web Hosting Statistics For 2025: What Is The State Of The Hosting Industry? – Bloggingwizard

4: The Big Three Stay Ahead in Ever-Growing Cloud Market – Statista

21+ Top Cloud Service Providers Globally In 2025 – Cloudzero