October 2013 marked the start of the expansion of the root zone with potentially unlimited new extensions: at the last day of that month the Arabic extension .موقع (‘shabaka’ or ‘.web’) opened for trademark holders. No, don’t stop reading here: I won’t repeat the whole history of new gTLDs (“nTLDs”) again. If you want to read that – just go to our website and read the older blog posts.

October 2013 marked the start of the expansion of the root zone with potentially unlimited new extensions: at the last day of that month the Arabic extension .موقع (‘shabaka’ or ‘.web’) opened for trademark holders. No, don’t stop reading here: I won’t repeat the whole history of new gTLDs (“nTLDs”) again. If you want to read that – just go to our website and read the older blog posts.

Instead, I want to unveil the business case of “new gTLDs” in Openprovider to you. This blog post was inspired by a question of our CEO: “can you see if we make money on new gTLDs?” which turned out to be in fact another question: “can you create a presentation for Domaining Europe that I can use to talk about our new gTLD strategy?”

Yes – of course! As I wrote before, I love numbers! So I will tell you in this blog post about 98% coverage, €165.000 investments, 31% adoption and more. Read on! If you are not such a numberphile, you may have a tough reading ahead but I’m sure you will find a lot of interesting information!

Some numbers

Let’s start with some dry numbers. Depending on how you count, we’re approximately 2½ years underway. At this moment, we have 22.080 domains under management in 420 different extensions with 100 different registries. We have done 184 “brute forces” with an average success rate of 91% and earned a lot of money – and spent a lot of money as well. One third of our customers manages one or more new gTLDs and 10% of them also manages one or more premium domains. Let me clarify those numbers in more detail.

About the extensions

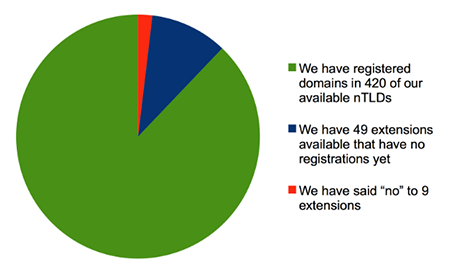

Only counting the extensions that are more or less open for registration – and thus excluding the brand extensions that can only be registered by that specific brand, like .barclays – there are 479 extensions available in which one can register domains. Openprovider is accredited for 470 of them. Not all, because for some of them it’s really impossible to create a business case. Still, it’s a 98% coverage. Although we have not registered domains in every single extension, we did so in 420 of them (89%).

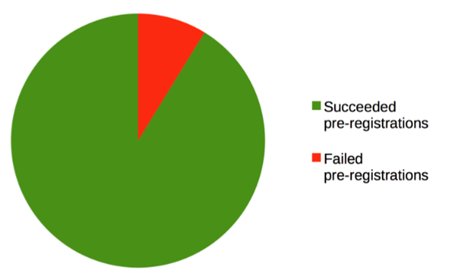

To process the domains that our customers pre-registered, we have participated in the start of 184 General Availability starts. We call them “brute forces”, as in the second that the registry opens its doors, all registrars worldwide try to claim the domains for themselves or their customers. It’s a bit of gambling, especially for the more generic names. Still, our average success rate on almost 6.300 pre-registrations is 91% – 9 in every 10 of our customers’ orders succeed. Many brute forces even have a 100% success rate.

About the registries and our investment

Those 470 extensions are operated by 100 different registries. Some of them are easy, others are more complex as for geographic or language barriers. Some of them are cooperative, others really seem to try to scare off registrars as much as possible. Anyway, those 100 different registries have led to where we’re standing now – and 1½ meters of contractual paperwork.

Although registries often choose for the same back-end operators (for example Afilias, CentralNic or TCI), each registry needs resources for accreditation, documentation, implementation and maintenance. In total, we count around 30 different back-end providers.

Over the past 2½ years, we have spent around 9.500 hours spread over all these areas. The total investment in people is close to €165.000. Apart from these expenses, we’ve paid around €15.000 on accreditation fees and have on average €100.000 outstanding, spread over 30 prepaid balances. New gTLDs only!

Oh, and don’t forget our financial department which must process up to 100 invoices each month and take care of all corresponding payments and prepayments.

An unforeseen financial pain appeared to be the banking costs: many registries only support wire transfers, which are EXPENSIVE. An overhead of €50 on a payment of just €10 is no exception. A good reason to strive towards higher volumes, as that will spread these costs over more domains!

About our gains

Of course, we won’t have invested in new gTLDs if we would not believe in them. We’re a commercial company and a business case must be profitable. Still, nobody could predict the results as it is a brand new era. Knowing our investments, one must know about revenues and margins as well in order to judge this business case.

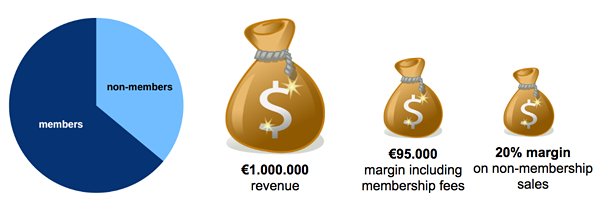

We have received around €1.000.000 on revenues, 65% of it coming from our members. Over the remaining €350.000, our margin is €70.000 (calculated as domain revenue minus domain cost). This is 20%. As for our members, the New gTLD Memberships provide a margin of approximately €25.000. It would be fair to also take into account a share of our many Supreme Memberships, but I didn’t dive into that much detail.

About our customer’s gains

Maybe it’s interesting to see what our customers earn on the new gTLDs. Of course they did not need to invest the amounts that we did, although some investment in marketing might be realistic. We have asked a couple of our Supreme members about their experiences. Most of them put a fixed margin on the cost price, ranging from 35% to 100%. The good thing on such a high margin is that it leaves room for promotions. On the other hand: one of our customers reports an average margin of just €0,95 per domain.

They all report that the relative margin is lower than the margin on legacy extensions (which could easily be 100-200%), but as for the higher cost price the absolute margin is higher. It is important to know that the volumes are lower, though.

About customer adoption and premium domains

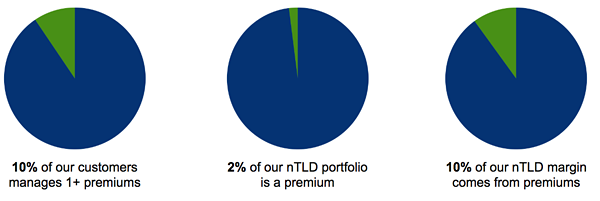

Who buys new gTLDs? Many people and companies! Out of our 3.846 active customers, 1.204 customers (31%) currently manages one or more domains in the nTLDs.

Premium domains are a new concept within the domain landscape. Registries select a list of domains for which they want to receive higher registration and sometimes renewal fees. Personally, I did not see the added value when we started the new gTLDs. But as time evolved, those premiums proof not only to be additional money for the registry, but it also allows for higher margins. From non-financial perspective, it leads to a higher active use of premiums – the domain holders really have an interest in them.

How does this look in Openprovider? We have sold 448 premium domains, which is 2% of our total nTLD domain volume. Although a small volume share, both the premium’s margin and revenue count for 10% of our total.

These 448 premium domains have been registered by 126 different customers. This means that roughly one in every ten customers manages a premium domain.

About renewal rates

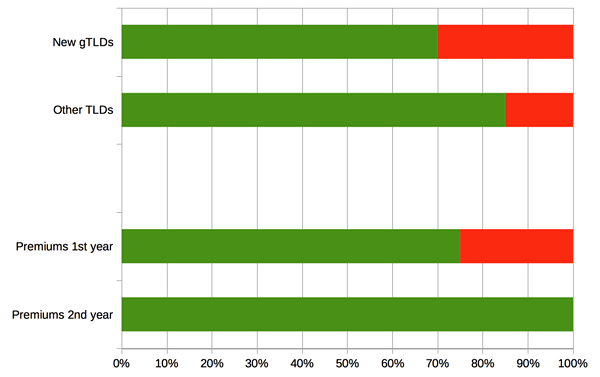

Maybe the biggest unknown before the nTLDs were launched was the renewal rate. So far, we have had 13.397 domains which have reached their renewal date already. 70% of them (9.341 domains) have been renewed. The remaining 30% is a combination of deletes, expirations and outgoing transfers.

Compared to the global renewal rate of new gTLDs (very scattered information, but I estimate it around 60-65%) we’re doing better, but 70% is lower than the Openprovider-wide renewal rate of 85% on all extensions.

Interesting finding: the renewal rate on premium domains is higher than average in the first year, and 100% for the second year of renewal.

How do new gTLDs compare to legacy TLDs?

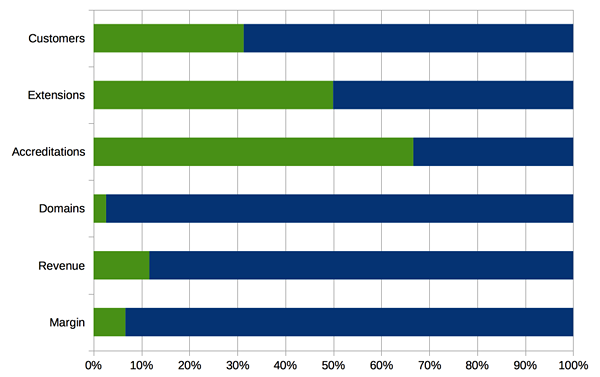

As an image is worth a thousand words, let me conclude with an image. The green shares in the graph below are the new gTLDs. For example, read this as “65% of our accreditations is for new gTLDs”.

So far my numerical analysis of the first 2½ years of new gTLDs. I am really curious towards your experience. Share it in the comments below or drop me an e-mail at blog@openprovider.com!